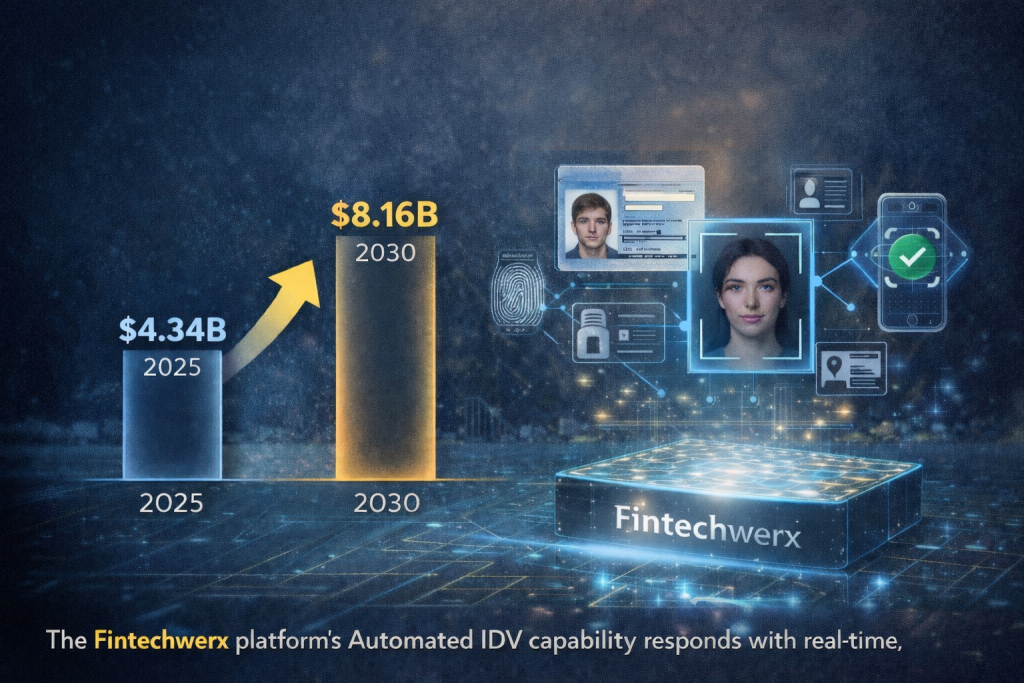

The US identity verification market is projected to nearly double – from $4.34 billion in 2025 to $8.16 billion by 2030 – driven by one key recognition: single-point checks no longer cut it. The Fintechwerx platform’s Automated IDV capability responds with real-time, multifactor validation that simultaneously analyses document authenticity, facial biometrics, liveness detection, and behavioral signals. This layered approach makes fraud economically less viable – bypassing multiple controls requires so much more effort that most fraudsters move on to easier targets.

Deepfakes, Synthetic Identities, and the New Arms Race in KYC - How Fintechwerx Stays Ahead

Deepfakes, Synthetic Identities, and the New Arms Race in KYC – How Fintechwerx Stays Ahead

Fintechwerx Blog | Identity Verification (IDV) | February 2026

Where a convincing fake passport used to require criminal skill and significant resources, in 2026, generative AI tools can produce one in under 30 minutes for as little as $15. According to Sumsub’s 2025–2026 Identity Fraud Report, AI-generated documents are already a leading fraud trend – and the technology is accelerating. Deepfake video impersonation, synthetic identities, and coordinated automated attacks are commercially available, scalable, and targeting onboarding flows across financial services, e-commerce, and regulated industries. Businesses relying on a single ID check at onboarding are now dangerously exposed.

Critically, the platform is engineered around full KYC and AML compliance, keeping businesses ahead of tightening frameworks from FINTRAC to PSD2. And enhanced verification doesn’t mean slower onboarding: organizations that have adopted AI-led, multi-signal verification report 30–40 percent faster onboarding turnaround, because automation replaces manual review with near-instant decisions.

As AI agents begin transacting on behalf of users, Fintechwerx is moving forward to monitor the next frontier – Know Your Agent – and its adaptable architecture is designed to evolve with the threat landscape.